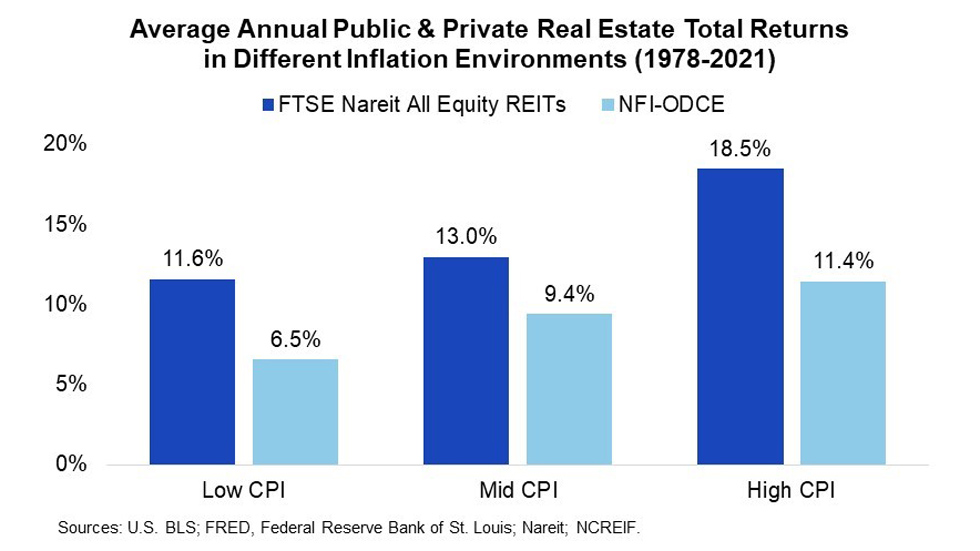

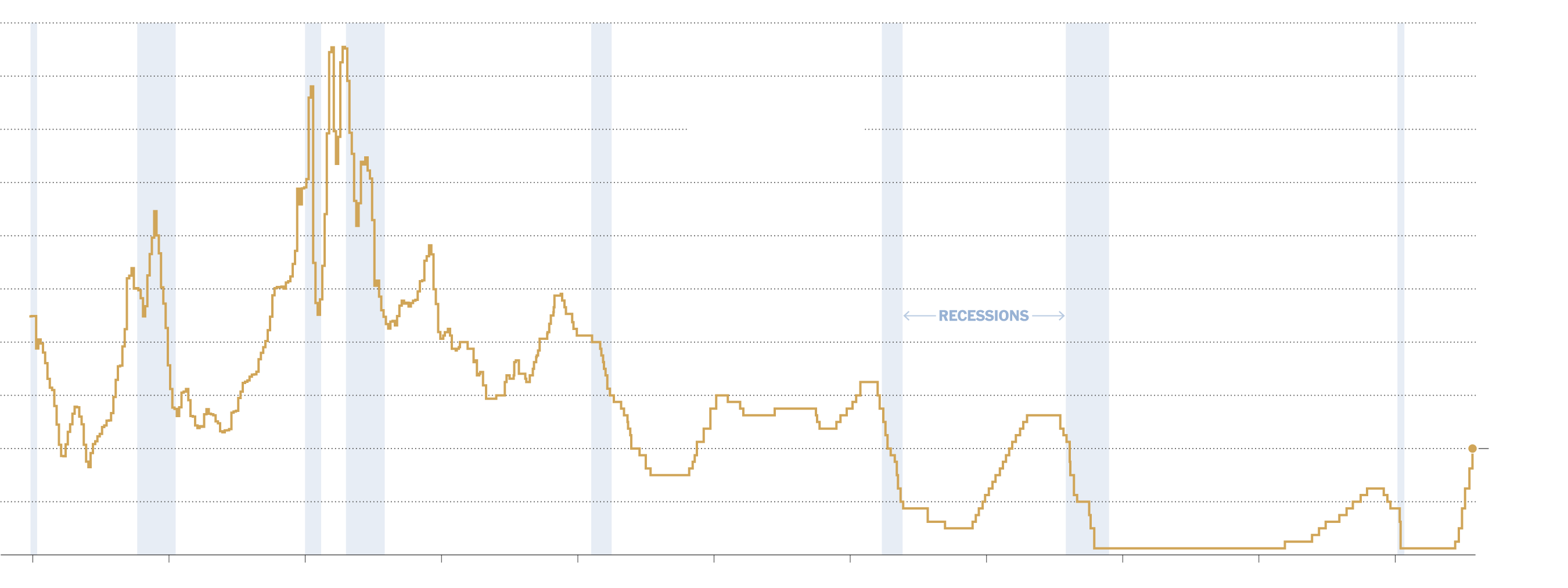

REITs’ operations remained strong with solid year-over-year increases in funds from operations (FFO) and net operating income (NOI), as they continue to navigate a period of rising interest rates and persistently high inflation, according to new third quarter data from… Read More

REITs Positioned for Uncertainty