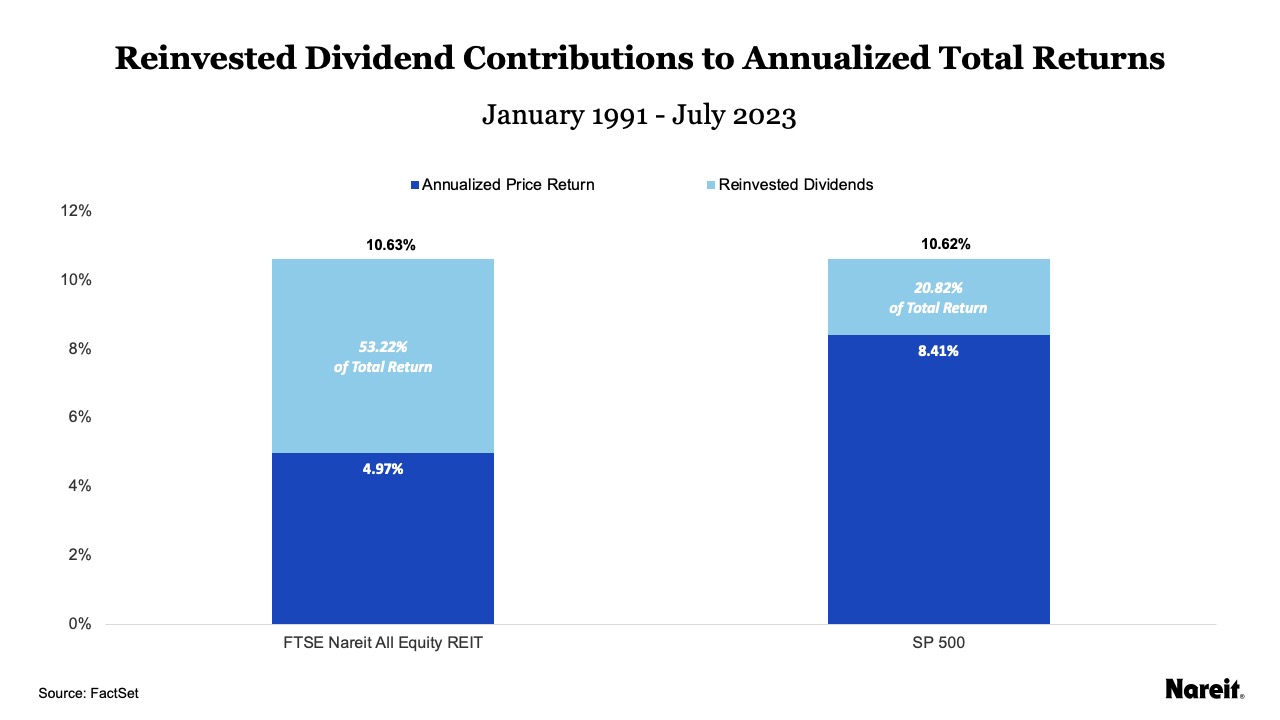

In making the case for an allocation to real estate in an investment portfolio, one of the oft-cited arguments is real estate’s ability to generate income. Historically, U.S. public equity REITs have provided attractive and reliable income streams to investors, on average, outshining their equity and private real estate counterparts. By design, REITs must distribute at least 90% of their taxable income to shareholders as dividends. As a result, dividends are an important component of REIT total returns. For investors seeking income, REITs can deliver.

Looking for Income? REITs Deliver