At Chipotle Mexican Grill’s newest restaurant in Chicago, busy diners don’t have to step foot inside the restaurant to grab their carryout order. Instead, they can fetch their foil-wrapped burrito or Lifestyle bowl from a walk-up window.

It’s the fast-casual chain’s only restaurant with a curb-facing counter designed for picking up off-premise orders, a fast-growing part of the Newport Beach, Calif.-based chain’s business.

It’s the brand’s only walk-up window. But more could be on the way as Chipotle battle tests a new store design geared toward the chain’s billion-dollar digital business.

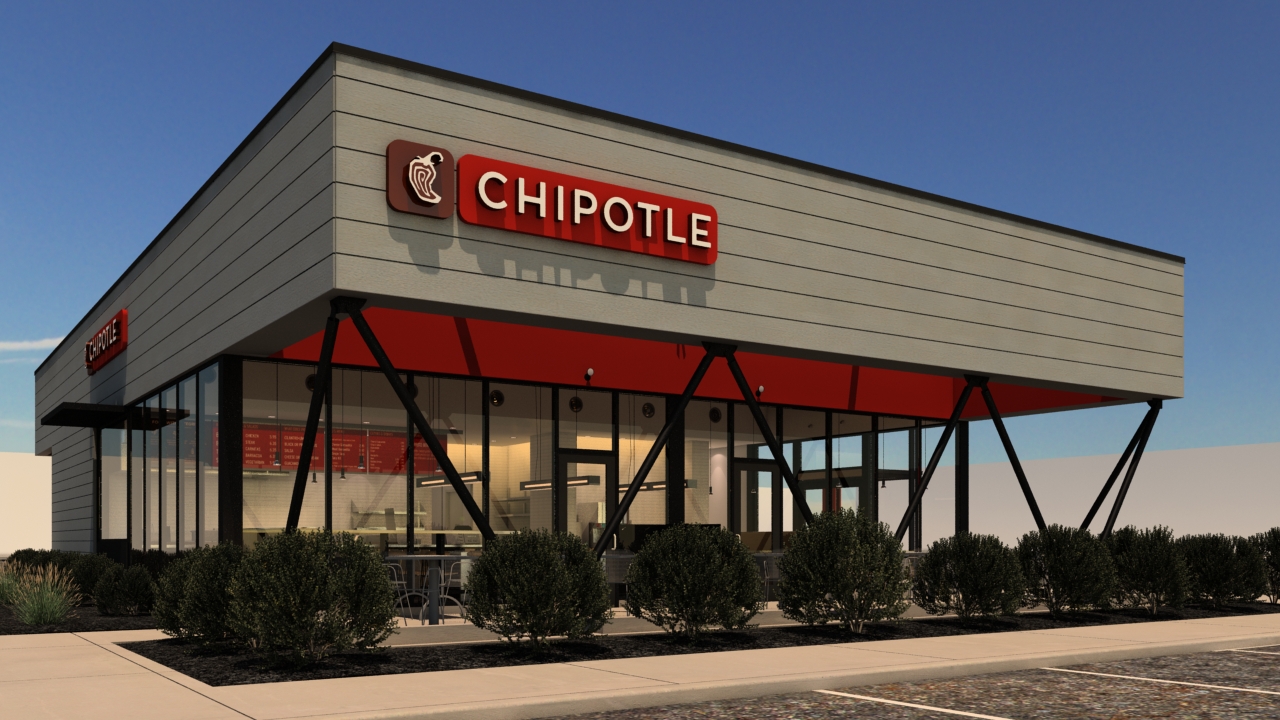

Prototype stores, which have been rolling out in various markets from Southern California to Chicago, feature eco-friendly furniture, high-top tables, a lower glass partition along the dine-in queue and pick-up shelves near the front entrance.

Chipotlechipotle-prototypes-two.png

“Our eco-friendly, natural aesthetic and locally sourced approach to this design builds on our strong brand values and mission of cultivating a better world,” said Tabassum Zalotrawala, chief development officer of Chipotle.

Shelves for to-go orders have been around for months, but these next-generation stores take a strategic approach by putting them closer to the entrance.

“The consumer today wants more and more convenience and so the design really addresses these multiple points of revenue,” Tabassum Zalotrawala, Chipotle’s chief development officer, told Nation’s Restaurant News in a recent interview at the company’s headquarters.

Designing for booming digital business

Digital sales at Chipotle accounted for 19.6% of total sales in the fourth quarter, ended Dec. 31, 2019, up from 12.9% for the same period in 2018, the company said last month.

The fast-casual chain posted a 13.4% jump in same-store sales, the eighth consecutive quarter of growth for the company, and third consecutive with growth in the double digits. Transactions are also up 8%.

Native orders, or orders made through the company’s app, are helping drive digital sales, which grew 78.3% to $282 million for the quarter.

“The progress we’ve made here continues to be a standout story,” chief executive Brian Niccol said.

The CEO is not letting up.

The brand is hotly pursuing the development of frictionless ways for on-the-go diners to fetch their food.

ChipotleChipotle-mobile-orderpickupsign.JPG.png

Chipotlane signage shows Chipotle customers where to go to pick up mobile orders without leaving their car.

Prototype stores, some of which include Chipotlanes, are part of the equation.

During the fourth quarter, the company opened 80 new restaurants, a record for the brand. The openings included 46 Chipotlanes — car lanes for picking up mobile orders without entering the restaurant — bringing the total to 66.

For 2020, Chipotle said it plans to open 150 to 165 new restaurants. Of those, more than half will include a Chipotlane.

Niccol, who came to Chipotle from Taco Bell two years ago, understands the value of quick-service drive-thru lanes. In the QSR industry, drive-thru lanes typically generate about 60-70% of total sales.

“We definitely see a sales increase associated with adding that additional access,” Niccol said during a December investor conference. “We love what the economics look like.”

After ordering ahead at Chipotle, Niccol said customers can use a Chipotlane to grab their order in about 10 to 15 seconds.

“This is the fastest way to get food,” he said.

Could Chipotlanes eventually generate sales that rival those of QSR drive-thrus?

“Absolutely. Never say never,” Zalotrawala said.

Noting the pace of the brand’s digital business, “I do expect [drive-thru revenue] to increase over time,” she said.

Noodles & CompanyNoodles-Drive-up-Window.png

The brand’s University Avenue location in Madison, Wis.

Chipotle tweaks trend started by fast-casual peers

Chipotle is not a fast-casual maverick when it comes to adding car lanes.

Brands like Panera Bread, Corner Bakery, Starbucks, Jersey Mike’s and The Habit Burger Grill have been adding QSR-style drive-thru lanes for years.

The Habit, recently acquired by Taco Bell parent Yum Brands, began experimenting with drive-thrus in 2011.

Now, roughly 20% of the company’s 271 locations have car lanes. The Irvine, Calif.-based fast-casual burger chain has been stepping up the experiment over the last two years as part of its “total access” plan, CEO Russ Bendel said.

That plan includes adding self-serve kiosks, expanding drive-thru locations and increasing digital ordering channels.

“We’ve tried to become much more convenient across a lot of different platforms,” Bendel said.

But Chipotle’s drive-thru lanes comes with a twist.

Chipotlanes are for pick up only. There’s no ordering involved.

Fast-casual chain Noodles & Company also has been experimenting with pick up lanes since late 2018. The Broomfield, Colo.-based brand now has eight locations with drive-up windows. Another three are in the works.

Niccol believes its modified drive-thru lane is the way to go for fast casual.

“This is what drive-thru should be. The actual [QSR] drive-thru experience is not great,” Niccol said. “That order board — people do not like that experience.”

Convenience is not just limited to Chipotle’s to-go business.

The chain’s new prototype stores feature elements to ensure off-premise business doesn’t impact dine-in customers.

A prototype store near the company’s Newport Beach headquarters features pick-up shelves at the front entrance, a mix of barstools and community tables and a lower glass partition along the dine-in queue.

Having the glass lowered makes it easier for dine-in guests to communicate with employees as they walk along the assembly line. Grab-and-go bottled beverage drinks are also located near the cash register.

“The openness of this design will aim to increase communication and foster a sense of community with the restaurants,” the company said.

New pick up shelves are a key element of prototype stores, which have been rolled out in Chicago, California, Ohio and Arizona.

The shelves are closer to the store entrance, and strategically connected to the kitchen — steps away from the brand’s much talked about digital second-make lines.

Nancy LunaChipotle-Prototype-Shelving-Newport.png

In-store pick up shelves are closer to the front entrance in prototype stores. The open shelves are also easily accessible to employees prepping off-premise orders.

The food prep area contains easy to read digital instructions for employees dedicated to preparing off-premise orders made through third-party delivery or the chain’s app, which reached 8 million registered members in the latest quarter.

Chipotle leaders have repeatedly said that the enhanced technology of the digital make lines increases speed and accuracy, while not interfering with dine-in orders.

Zalotrawala said guests grabbing carryout orders don’t have to cross paths with dine-in customers as their food is located near the door. For employees, the back side of the relocated shelves can easily be accessed from kitchen.

“It’s solving for friction both with the customers that are dining in the restaurant and those picking up their food and going away,” Zalotrawala said. “There’s easy access for our associates that are working in the back of house.”

Other restaurant brands are also reimagining the store of the future.

Fast-casual chain Shake Shack, which is growing at breakneck speed, recently launched a new 2,900-square-foot format express store in New York City in late December.

CEO Randy Garutti said the restaurant was designed for the “digital Manhattan” crowd. It has fewer seats, roughly 72 inside and out and a bank of four kiosks and pick up shelves for takeout orders.

In an unusual design twist, one entry/exit is designated for digital customers while another is geared for dine in guests.

At Chipotle, the next-gen stores are meant to balance off-premise needs with dine in sales, which are not being cannibalized by digital orders, Zalotrawala said.

“We haven’t noticed a huge difference or even a little difference actually in dine in sales,” she said.

In 2020, Zalotrawala said consumers can expect to see more Chipotles adopt the new look.

“We’re already starting our remodels for the year that are based on this design,” she said. “We should start seeing a few remodels come to life in Q2 and then absolutely in the back end of the year.”

Gary Stibel, founder and CEO of The New England Consulting Group, said what Chipotle is doing for its digital business is smart because they’ve created access points that work for their brand.

And the results are showing.

“That brand is on fire,” he said.

Still, Stibel, a veteran industry consultant, said Chipotle is just scratching the surface.

“They’re still missing a lot of potential delivery orders where their restaurants are simply too far away from potential customers who would like to have Chipotle.”

If Chipotle continues to push quality along with digital innovation under the current “smart management team,” then further gains will be made, he said.

“We don’t think they’re done.”