Most reviews of the best-performing market sectors focus on capital appreciation. If we look at the first four months of 2021 through that lens, we’d have to say that Bitcoin—if you consider the cryptocurrency a sector—handily beat out all competitors…. Read More

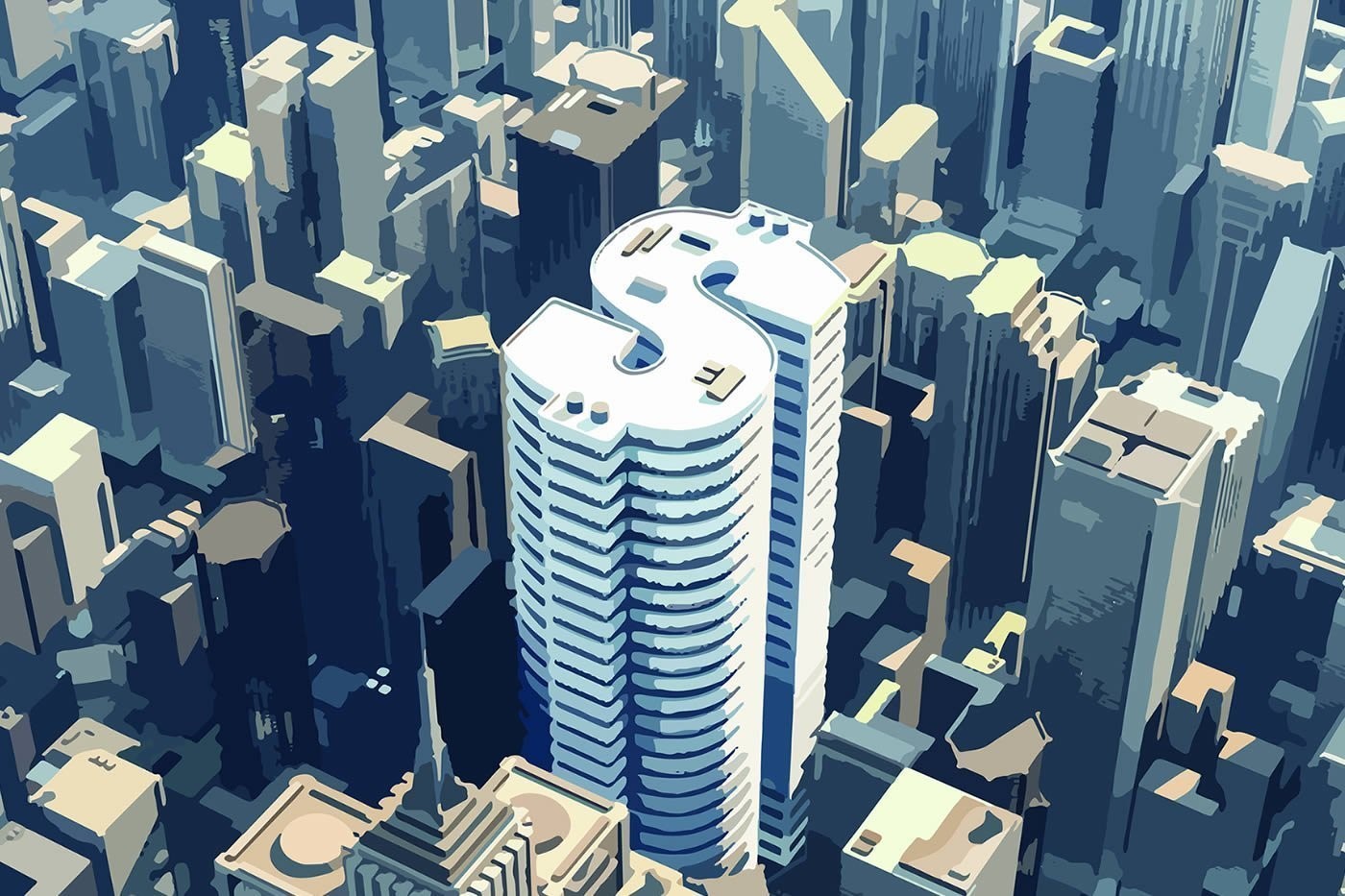

Real Estate is This Year’s Top-Performing Sector