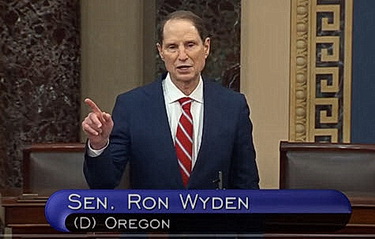

The Real Estate Roundtable and 22 other national real estate organizations wrote today to Senate Finance Committee Chairman Ron Wyden expressing significant concerns regarding his draft legislation to overhaul partnership tax rules. The letter was sent after congressional leaders and Treasury Secretary Janet Yellen yesterday announced they had agreed on a framework for moving forward with human infrastructure legislation, which includes a list of tax issues for discussion and potential inclusion in a final reconciliation bill. Additionally, the House Budget Committee announced it would “mark up” the combined $3.5 trillion reconciliation bill tomorrow. (Coalition letter, Sept. 24 and BGov, Sept. 23)

Why It Matters

- On September 10, Chairman Wyden proposed a far-reaching restructuring of partnership taxation that would raise at least $172 billion over 10 years. Chairman Wyden or others could put forward the partnership proposals as revenue provisions for the reconciliation bill.

- Real Estate Roundtable President and CEO Jeffrey DeBoer stated, “Partnerships are used to bring parties together to create and grow businesses that propel job creation, new investment, and productive economic activity. Partnerships contribute immensely to the culture of dynamic entrepreneurship and risk-taking that is missing in many parts of the world where business activity is dominated by large, public corporations. In this current environment, Congress should be working on ways to encourage and strengthen partnerships, not cut their knees out from under them.” (Roundtable Weekly, Sept. 10)

- Nearly half of the four million partnerships in the United States are real estate partnerships. These pass-through businesses are a key driver of jobs, investment, and local tax revenue.

- Provisions in the draft bill would alter the tax rules that apply when a partnership is formed and property is contributed, creating new barriers to business formation. Other provisions would changes the rules when a partnership borrows to finance its growth and expansion, as well as when a partnership distributes profits and gains to the owners.

- Many of the provisions in Wyden’s draft would apply retroactively to economic arrangements entered into years, and sometimes decades, earlier. A proposal requiring that partners share all debt in accordance with partnership profits could overturn decades of tax law with respect to nonrecourse borrowing by a partnership.

- The coalition of 24 real estate organizations stated, “With millions of Americans still unemployed and others who have yet to return to the labor force, we encourage you to focus instead on reforms that will strengthen and expand partnerships’ ability to create jobs and economic opportunities.” (Coalition letter, Sept. 24)

Infrastructure / Reconciliation Developments

- A vote on the bipartisan infrastructure legislation is expected on Monday, Sept. 27 or Tuesday, Sept. 28, but that could change depending on Democratic leaders’ ability to ensure sufficient votes for passage.

- The House Budget Committee’s scheduled mark-up the $3.5 trillion reconciliation bill on Saturday afternoon, Sept. 25 will proceed as Democrats race to reach consensus with moderates who object to the bill’s overall price. (PoliticoPro, Sept. 23)

- The framework deal between House and Senate Leaders reportedly includes an understanding between Senate Finance Committee Chairman Ron Wyden (D-OR) and House Ways and Means Committee Chairman Richard Neal (D-MA) about revenue-raising proposals that could be used to pay for the massive proposal. (The Hill, Sept. 23)

- Senate Majority Leader Chuck Schumer (D-NY) described the agreement as a “menu of options that will pay for any final negotiated agreement” as Pelosi called it “an agreement on how we can consider, go forward in a way to pay for this.”

Roundtable Resources

- Tax issues affecting CRE are summarized in The Roundtable’s summary on Real Estate Tax Issues and Budget Reconciliation Legislation.

- The Real Estate Roundtable on Sept. 17 held an all-member Town Hall discussion on specific measures in the House’s human infrastructure bill, including its tax policy aspects. The event featured Roundtable Chair John Fish (Chairman and CEO, Suffolk), Roundtable President and CEO Jeffrey DeBoer and Senior Vice President & Counsel Ryan McCormick. (Roundtable YouTube channel)

- DeBoer also discussed tax law policy proposals under consideration in Washington and the need to distribute federal rental assistance to property owners and tenants during a recent Connect webinar, which also included National Multifamily Housing Council Chair David Schwartz (Chairman and CEO, Waterton) and NMHC President Doug Bibby. (Connect, Sept. 23)

Infrastructure bills and tax policy issues in play that may impact commercial real estate will be the focus of discussions during The Roundtable’s Fall Meeting on Oct. 5 in Washington, DC (Roundtable-level members only).